Calculating tax title and license

What You Should Know About Tax Title And License In Texas Tax Title and license are. 5 Infrastructure Maintenance Fee 500 max NA.

Florida Vehicle Sales Tax Fees Calculator

If you have a trade-in you only pay tax on the difference between the value of your trade-in and the sales price of a new vehicle.

. For example if the total of state county and local taxes was 8 percent and the. The county the vehicle is registered in. You can calculate sales tax on used and new vehicles by multiplying the cost of buying the car by 625.

16450 for an original title or title transfer 85 Registration Fee Note that while tax title and license fees can differ based on the type of vehicle being purchased weve. To calculate registration fees online you must have the following information for your vehicle. In addition the title license fees will total about 100 or less.

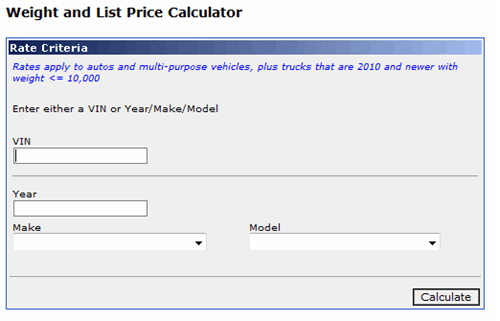

This feature is used to determine registration fees by vehicle identification number or by selecting make year and model. Multiply the sales tax rate by your taxable purchase price. Our Premium Calculator Includes.

Tax and Tags Calculator When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. You can do this on your own or use an online tax calculator. For instance if a vehicle is sold at 20000 the sales tax is.

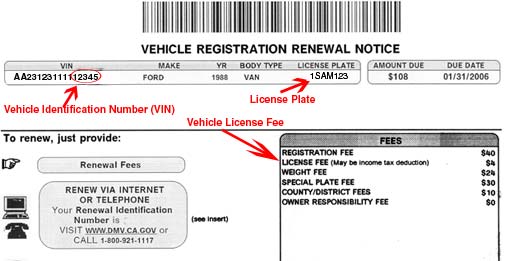

Calculate My Fees Tax Season Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be. 250 infrastructure fee if transferring. 46-116 Gross Vehicle Weight Fee.

Title 19 - Annotated Browse or Search the complete United States Code Title 19 - Customs Duties with. North Dakota Title Number. Customs Duties Law 2012 USC.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. VIN If you know the VIN Vehicle Identification Number of the vehicle. Your annual vehicle registration payment consists of various fees that apply to your vehicle.

52 rows Annual personal property tax based on vehicle value. You are required to select the type of ownership of your vehicle at the time you register in Vermont learn about the types of vehicle ownership and when this designation is important. Our Premium Calculator Includes.

How are tax title and fees calculated. 2000 x 5 100. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Tax title and license calculator - US. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625 percent. Or the following vehicle information.

Once you have the tax rate multiply it with the vehicles purchase price. The Vehicle License Fee is the portion that may be an income tax deduction and is what is.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Texas Used Car Sales Tax And Fees

How To Calculate Sales Tax In Excel

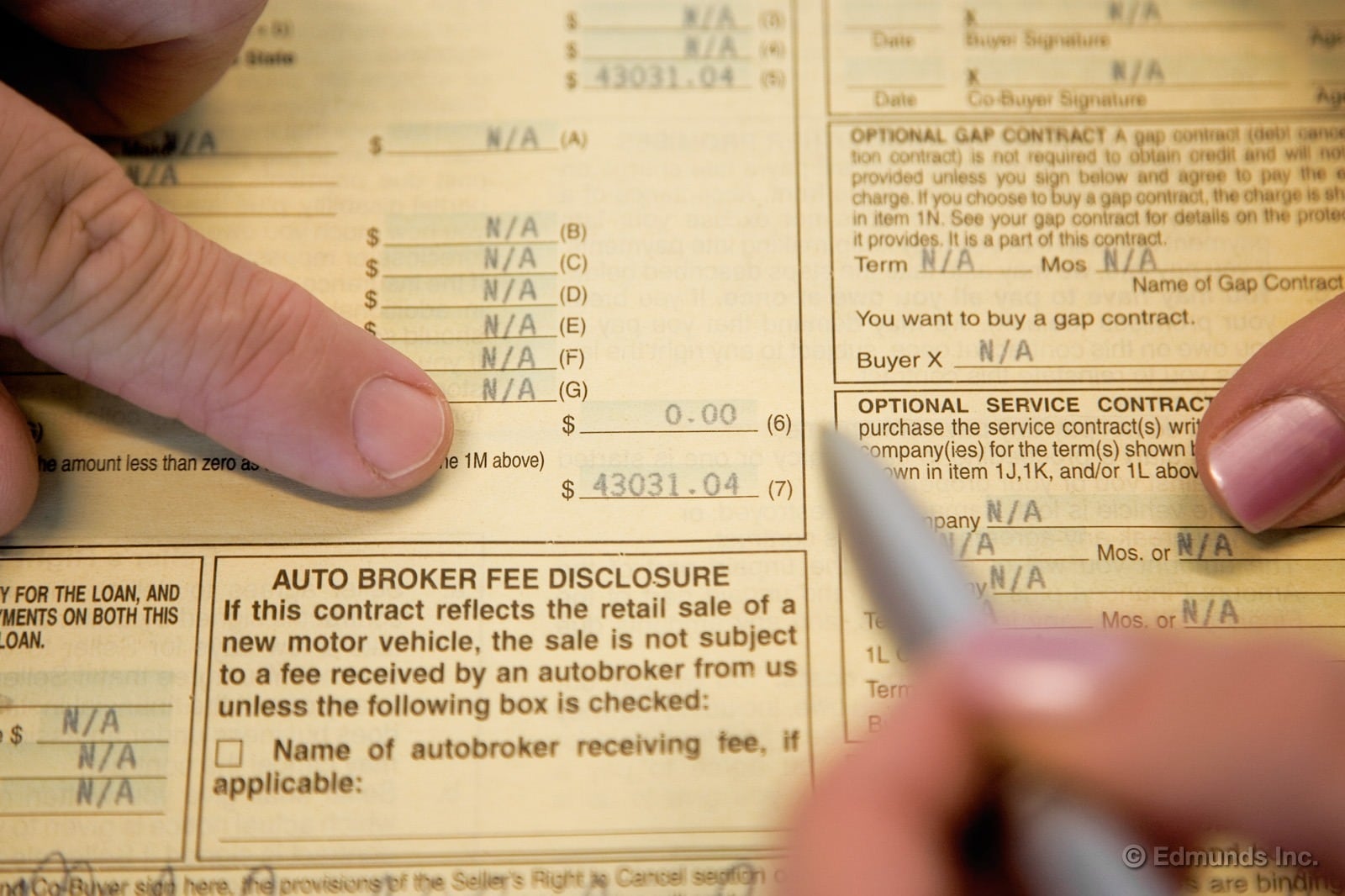

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Vehicle Registration Licensing Fee Calculators California Dmv

How To Calculate Sales Tax In Excel

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

California Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator